What is a Successful Withdrawal Rate?

I had someone recently ask me “what do you even do with your money when you retire?” When you start to think about the future and retirement, do you ever wonder how much you can safely withdrawal each year? In America, we have a problem with people running out of money in retirement. I want to make sure that I am not one of those poor people.

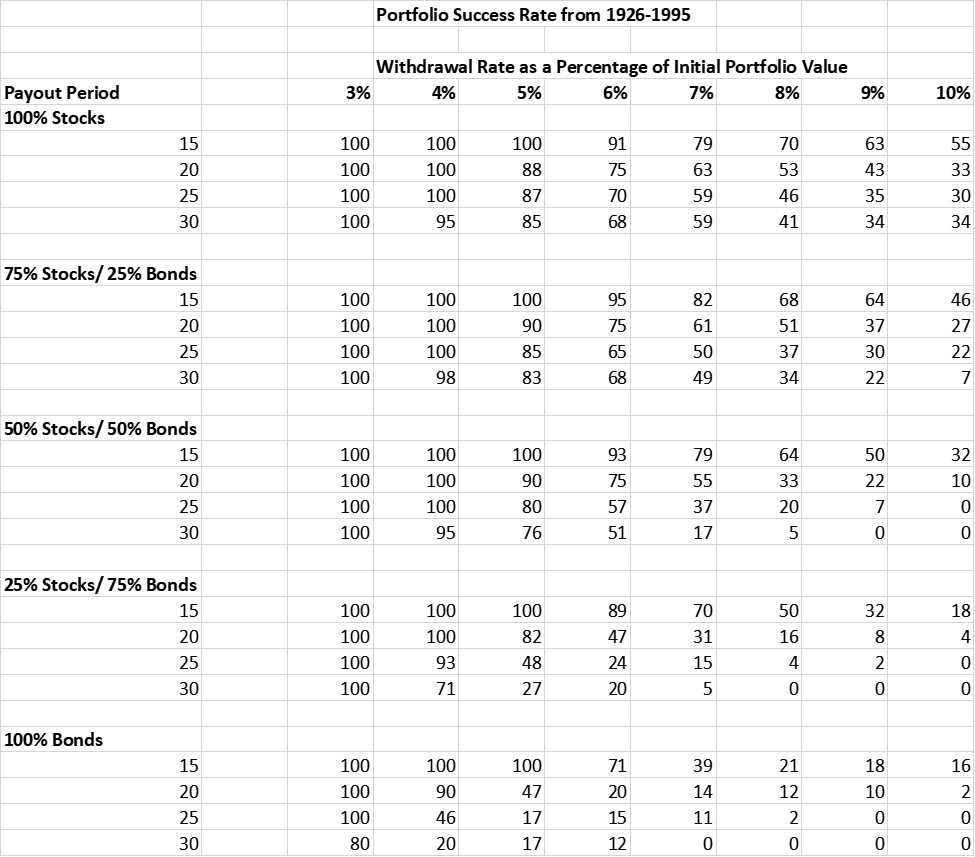

In the financial independence community, the Trinity Study is one of the most referenced studies. Philip L. Cooley, Carl M. Hubbard and Daniel T. Walz were responsible for the Trinity Study and wrote the paper called Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable. It was initially performed in 1998 and was recently updated. Their study looks at a couple different ranges of dates and withdrawal rates. They also used different percentages of stocks and bonds to make a portfolio up. This table also takes into withdrawals adjusting for inflation at a rate of 3% per year.

Looking at the chart you can see a 4% withdrawal rate is conservative. Even assuming a 30 year retirement there is a 95% chance you will still have money left. A 3-4% initial withdrawal rate is a good place to start. The higher the withdrawal rate the less chance you have money at the end of the period. Also, you will notice at 100% bonds the success rate drops rapidly around the 4-5% range. I am thinking of long-term retirement, so I am more concerned about the 30-year time frame and beyond. I am currently trying to build wealth, so I have 100% in stocks. Once I get closer to retirement I will have at least 25% of my portfolio in bonds. Another updated version was done by Wade Pfau. He used a 5% inflation rate instead. He ran the number from 1926-2017. He also found the same results that 3%-4% is very successful. Now he takes it out to 40 years, which is good to see for early retirees. He found a 4% would fail 10-11% of the time at 40 years. Then after about 45 years the numbers will not change.

Something these success rates tables do not address is additional income after you retire. It assumes you will have no social security, no inheritance, no pension, and you will have no other means of income. As you know, most of us will probably work part time jobs when we retire. A lot of us will also have a pension. As I said before, social security and pensions are a bonus, but we do not want to fully depend on them. If we do have them then it can increase the success rate.

If we aim for a 3.5-4% initial withdrawal rate, we will be protecting ourselves against the bad times. We will be incredibly successful in the good times. Again, this is looking at early retirees. If you are retiring much later in life you can be successful with a higher withdrawal rate. When talking about the 4% rule Michael Kitces a well-known financial writer states, “over 2/3rds of the time the retiree finishes the 30-year time horizon still having more-than-double their starting principal. The median wealth at the end – on top of the 4% rule with inflation-adjusted spending – is almost 2.8X starting principal. In fact, even when starting with a 4% initial withdrawal rate, less than 10% of the time does the retiree ever finish with less than the starting principal. And it has only happened four times in the ‘modern era’ of markets: for retirees who started a 30-year retirement time horizon in 1929, 1937, 1965, and 1966.” Yes, it has happened, but these studies assume you continue to spend the 4% initial withdrawal rate with inflation increased every year and never cut back if needed. Remember this is also assuming you have no other income.

Since we are planning to retire early there is good news, even when the economy is bad. We are young, so we could work a part time job. This extra income would keep you under 4% and make never running out of money a sure thing. We can also cut back on expenditures if needed. If inflation in the US becomes a problem we could move to a different country for a couple of years. We have endless possibilities besides going back to a full-time job we hate. The key here is to remember we can make it through the financial roller coaster of the economy market and still be successful.

Here is the good news, if the economy is up for the first ten years after you walk away from your job, you will be an awesome shape. Your money will have potential to double. You could get so far ahead that a dip in the economy really won’t matter. If the economy is taking a huge dump on you during the first ten years, then take initiative and use one of the options mentioned above. Eventually the economy will recover and if you still have a decent (not even great) pot of money you will be fine. For example what would do if you had $1,000,000 and were planning on using a 4% safe withdrawal rate, but the economy was not performing well right after you quit your job? Are you going to panic? I hope not. Think about this, you get a part time job and make $10,000 a year. Well you just dropped your initial withdrawal rate to 3%. AKA you will be fine, and you can still set your own schedule.

To bring the point home, if you have $1,000,000 your safe withdrawal rate will be $35,000 (3.5%)-$40,000(4%). 3.5% would be an incredibly safe withdrawal rate, if you are someone who worries a lot. A 4% withdrawal rate still has a very high success rate, we just need to be smart if the economy starts sucking. It does take planning and discipline to make this work. Depending what you want your budget to be the numbers can increase or decrease. Financial Independence is achievable without working your entire life. The time to start saving is now, so you can live your dream life later.