The term FIRE means Financial Independence and Retire Early. I am going to tell you right away, don’t get to caught up in the RE of FIRE. Lots of people work part time jobs or side hustles after leaving their fulltime jobs. Some even get another fulltime job that pays less. Yes less, but it is something they have always wanted to do and are extremely passionate about. There is no set number for financial independence and there is no set timeline. This is not a get rich fast plan, but it is a smart plan. Imagine a get out of jail free card, but instead it is a get out of your job card. Sounds pretty good! Once you reach financial independence you will always have this in your back pocket. Meaning if something changes in your job or your life that you do not like, you can walk away from the situation without stress. This gives people a lot of confidence and happiness knowing this is an option.

The FIRE movement has been going on for quite a long time. People were doing it before it had a name. Do your self a favor and lookup Jim Collins and Vicki Robin. Both have excellent books and I highly recommend reading them. They have been retired for years and neither of them are close to running out of money. There are many other examples out there such as Mr. Money Mustache, Physician on Fire, The Mad Fientist, and many others. By the way, those are names of their blogs. Financial Independence is something that all these people have achieved and maintained. Not one of them wanted to be forced to work until they were 65 or older. Unfortunately, that is what a lot of people end up doing because they were given bad advice or were not efficient with their finances.

Here are some stats to prove how bad we suck at saving for retirement. According to the U.S. Bureau of Economic Analysis the savings rate for June 2018 was 6.8% of personal disposable income. Now let’s consider that the U.S. Census bureau says the average household income is about $60,000. Which means a typical household is saving $4,080 a year of their disposable income. Over someone’s career I bet this is not consistent and is probably less. That is average which means there is a large percentage of people saving under 6.8%. Now take this into consideration, according to the Government Accountability Office, “Among those with some retirement savings, the median amount of those savings is about $104,000 for households age 55-64 and $148,000 for households age 65-74, equivalent to an inflation-protected annuity of $310 and $649 per month, respectively.” We wonder why people run out of money in retirement. We know we shouldn’t rely on social security and it would be nice not to have to rely on our pensions. Maybe it’s time to think about investing for retirement differently. I plan on doing whatever the hell I want in retirement and I do not want to be stressed about money. So… it is time for a change.

The FIRE movement is about saving more and doing more with your life. Saving 6.8% of your income should not be acceptable. Why not save 50% of your income? This is not something you do overnight, but you can do it overtime. The more you save the quicker you will reach financial independence. Yup, it is that easy. We will talk what to do with this savings in a different article. A lot of people will see that 50% savings rate and begin to think that is impossible. For some it might be right now, for others is might not be. Others will say they do not make enough. You do not have to make even close to a six-figure salary to be successful at financial independence. Look at Ronald Read who was a janitor and gas station worker who had amassed 8 million dollars. Sure, it might take a little longer, but financial security and freedom is always worth the wait.

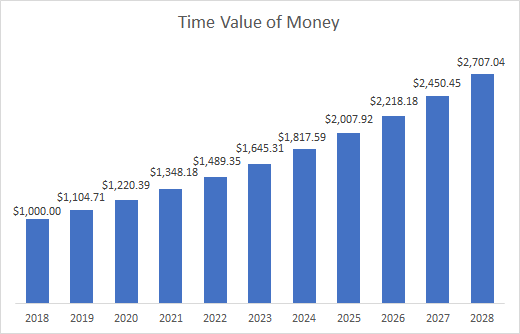

People in the US are insanely good at buying stupid shit. Unfortunately, what we buy is not always smart. I am not saying don’t buy anything, but I do try and think of what the actual cost of the item will be. I am not talking about the sticker cost, but what will I be missing out on had I bought the cheaper version of the item or not bought it at all and invested the money instead. I try to always think about compound interest. Here is a down and dirty example of putting your money to work with compound interest. Let’s say we invest $1,000 in an index fund. We just let it sit there for 10 years and let it earn interest for 10 years at 10%. Here is what you money will grow to.

That is just $1,000 and it already doubled in value by year 7. Now imagine you keep adding to that pot. That number is going to grow very quickly.

Firefighters, Police Officers, Paramedics, Military members, and other public employees can have their career cut short at any time. No one is immune to injury or an unexpected disease. We also can’t control our government’s handling of money or a levy failing. We need to protect ourselves from these kinds of events. We need to make sure we have a good defense in place. Remember a great defense (Emergency funds and a high savings rate) will lead to a great offense (The ability to invest heavily and put your money to work), which will set you up for success.

Being financially independent means freedom and protection. Your years of service no longer must be a benchmark of when you can retire. You are protected from the ups and downs of life. You are free to make decisions based on what will make you happies. You can live your life the way you, so you will have no regrets.